# The shortest path from guesswork to truth

Product-market fit survey questions are the fastest way to check if your product truly matters. Ask the right questions, then let customers show you where the value lives. Start with the Sean Ellis test, add JTBD, NPS, and qualitative prompts, and you get a clear picture of market validation, not just sentiment.

# Why product-market fit surveys matter

Hypotheses are cheap, adoption is not. Teams that run focused PMF surveys grow faster and retain better because they trade opinions for evidence. See the research behind the approach from Qualaroo and the 40% benchmark introduced by Sean Ellis. Useful background here: Qualaroo on PMF surveys (opens new window) and VivaTech’s methods to test PMF (opens new window).

# The 40% rule in one minute

- What it is: Ask, “How would you feel if you could no longer use this product?” Answers: Very disappointed, Somewhat disappointed, Not disappointed.

- Goal: 40% or more “Very disappointed.” Below that, expect growth friction.

- Source and deep dive: Learning Loop on the PMF survey (opens new window).

Short answer for a featured snippet: The Sean Ellis 40% rule says you likely have product-market fit when at least 40% of users would be very disappointed if they could no longer use your product.

# Build a complete question set

You do not need a 30-question epic. You need a tight set that exposes necessity, value, and friction.

Primary PMF check

- How would you feel if you could no longer use this product? (Very disappointed, Somewhat disappointed, Not disappointed)

Secondary validation

- How likely are you to recommend this product to a colleague? (0–10)

- What problem does this product solve for you?

- What do you like most?

- What would you improve first?

Feature value

- Which feature is most valuable to you and why?

- Which feature would you miss most if removed?

Competitive reality

- If you could not use this product, what would you use instead?

Usage pattern

- How often do you use the product? (Daily, Weekly, Monthly, Rarely)

- What workflows do you use it for? Any integrations involved?

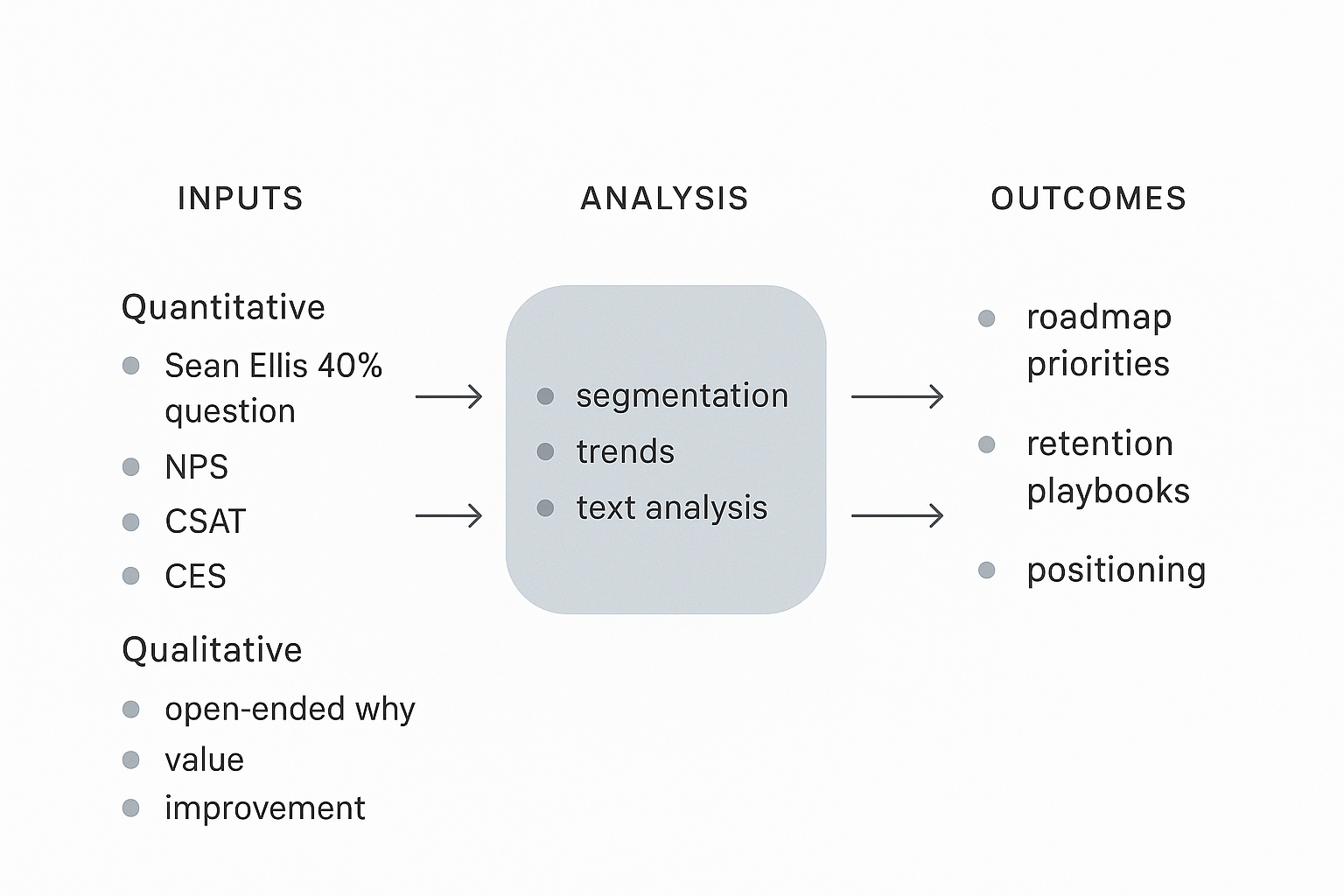

# Quantitative plus qualitative, not either or

- Quantitative: Track the PMF 40% score, NPS, CSAT, and CES over time. Segment by plan, persona, industry, and feature usage.

- Qualitative: Use open text to capture motivations, jobs, and friction you cannot see in numbers.

Featured snippet style answers

- How many responses do you need? 40 to 50 engaged users can make the PMF score directionally useful, more is better for segmentation.

- Who should you survey? Users who have used core features at least twice in the last two weeks.

Helpful references: Qualaroo’s overview (opens new window), VivaTech’s PMF testing guide (opens new window), and the Learning Loop play (opens new window).

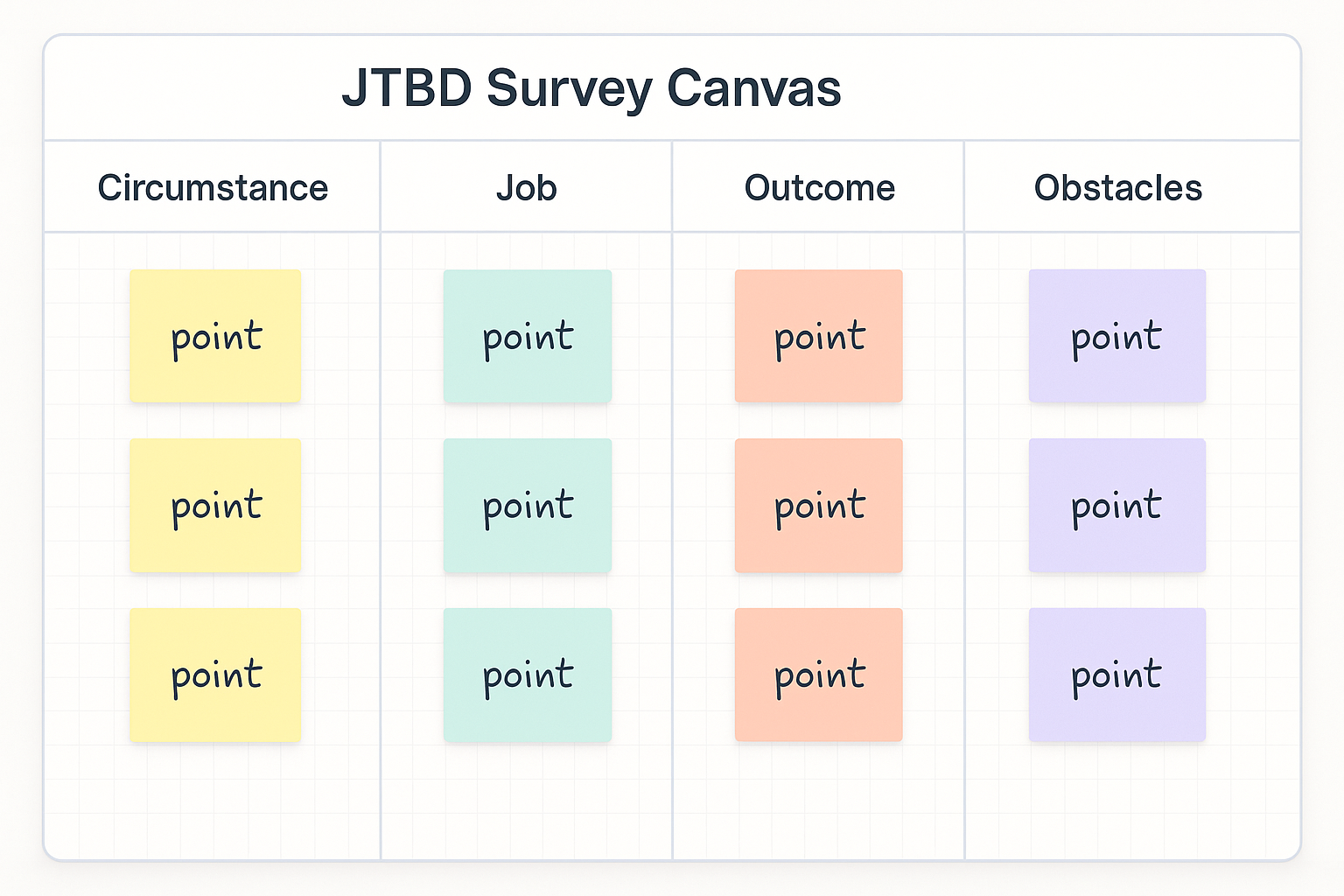

# Look through a JTBD lens

Jobs-to-be-Done reframes feedback around outcomes, not features. Customers hire your product to get a job done. Ask for the context, the job, and the desired outcome.

JTBD prompts

- When I am [circumstance], I want to [job], so I can [outcome] without [pain point].

- What alternatives did you consider to accomplish this job?

- What makes this product a better hire for that job?

Use JTBD answers to segment by primary job. You will find that different segments want different outcomes, which should shape onboarding, pricing, and roadmap.

# Design and deployment that respect the user

Keep the craft tight. Quality over volume.

- Targeting: Focus on recently active users who touched core features. Avoid single-use accounts.

- Timing: Weekday mornings and late afternoons work for most B2B audiences. Test and localize for time zones.

- Length: 5 to 13 questions. Use progressive profiling for depth over time.

- Flow: Start easy, then deeper, end with one open text prompt.

- Channels: In-app for relevance, email for reach. Use logic and branching to skip irrelevant paths.

# Analyze like a product team, not a pollster

Turn raw responses into decisions, not dashboards.

- Segment: By persona, plan, activation cohort, and feature adoption.

- Trend: Track PMF 40% over releases. Look for step changes after key shipping moments.

- Text analysis: Tag themes, measure frequency, and map sentiment to jobs and features.

- Correlate: Link scores to retention, expansion, and usage. High daily usage plus high PMF score is your core fit.

If you want help mining open text for themes and drivers, see how AI can surface insights without losing human judgment: Sleekplan Intelligence (opens new window).

# From insight to action, fast and clean

Insights that do not change the roadmap are trivia. Make the loop explicit.

- Weekly triage: Review new PMF data and top themes.

- Ownership: Assign each theme to a DRI with a target and a date.

- Experiments: Ship a focused fix or improvement within 7 to 14 days when possible.

- Communication: Close the loop with customers who asked for it.

Signals to watch

- Rising “Very disappointed” percentage in a specific segment.

- A feature mentioned in 30% of positive comments, but used by only 10% of accounts.

- A job statement that keeps repeating in churn reasons.

# A concise PMF survey you can run this week

Use this as a starting point, then adapt by persona and job.

- How would you feel if you could no longer use this product?

- What problem does it solve for you?

- Which feature is most valuable and why?

- Which feature would you miss most if we removed it?

- How often do you use it?

- What would you improve first?

- If not this product, what would you use?

- NPS: How likely are you to recommend us?

- CSAT: How satisfied are you with the latest release?

- CES: How easy was it to accomplish your key task today?

# Benchmarks and context that keep you honest

- PMF 40% score: Target at least 40% “Very disappointed.” Learn the nuance here: Learning Loop on PMF (opens new window).

- NPS: Useful as a loyalty signal, but read it with PMF and usage.

- Sample size: 40 to 50 engaged users gives you direction, then scale for segmentation.

# Common questions, quick answers

- Is NPS enough to prove PMF? No. Pair NPS with the 40% question and usage behavior. See the research from VivaTech (opens new window).

- When should I run PMF surveys? Quarterly for a full read, with smaller pulse checks tied to releases.

- Who should not be included? Users who have not used core features recently. You want fresh, meaningful experience.

# The craft that separates good from great

PMF measurement is not a checkbox. It is a habit. Be precise in wording, intentional in targeting, and disciplined in analysis. Use data to inform, not to abdicate judgment. The small choices add up: a crisp follow-up question, a clear tag taxonomy, a clean handoff from insight to roadmap. That is how teams earn fit and keep it.